For many decades, the chemical industry has been a fundamental part of the global economic landscape, making a significant contribution to achieving global goals through innovative, life-enhancing products and technologies. The German chemical industry is playing a crucial role in this, continuing to be the European leader in chemical sales, exports, investment and R&D expenditure. Local companies still export more chemicals than any other European country, even more than China. Whether in the reinforcement of traditional industry products or the sustainable development of emerging technologies, Germany plays a key role in setting benchmarks to advance state-of-the art technologies by developing new materials and high-performance chemicals and plastics. Here are 6 key questions and answers on Europe’s chemical industry powerhouse:

1. How big is the chemical industry in Germany?

In 2019 there was a total of 2,900 chemical companies in Germany, 96% of which are SMEs (small and medium enterprises). This so-called German “Mittelstand” is not only globally well known for innovation, but it is also the backbone of the German chemical industry. Together, SMEs bring in about one third of the chemical industry revenue and constitute 40% of the workforce.

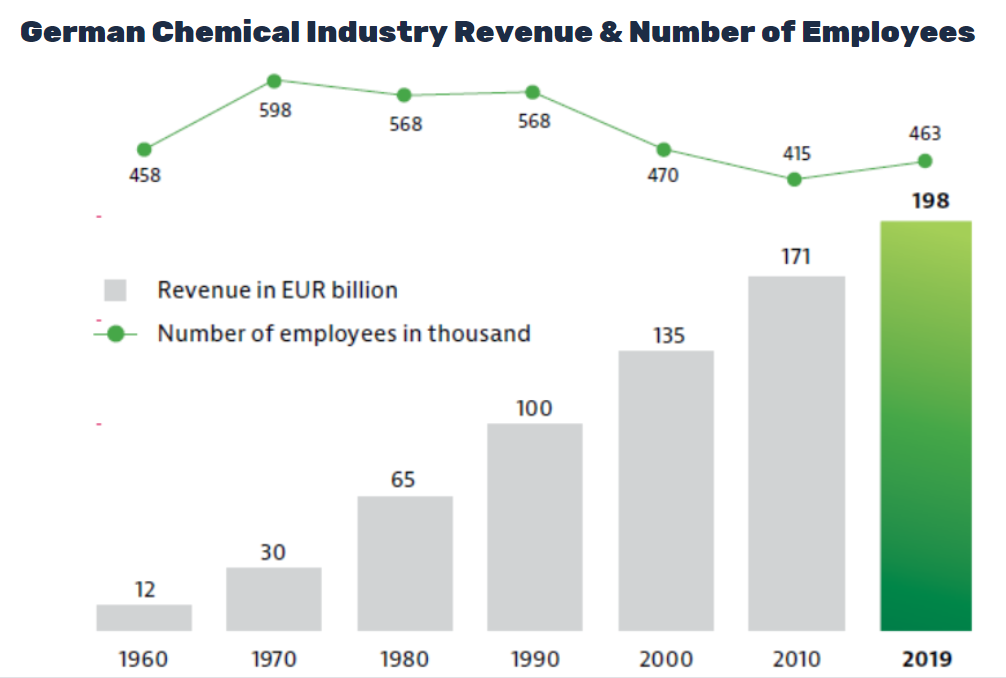

2. What’s the chemical industry’s revenue?

With an industry revenue of €147 billion in 2019, Germany has the largest chemical industry in Europe and the third largest in the world behind China and the USA. 27% of the total chemical industry revenue in the EU-28 is generated by German companies. From 1960 to 2020, chemical revenue growth was 4.8% on average.

3. Where does Germany stand in a global comparison?

With chemical industry exports over €118 billion and a global market share of 9.1% in 2019, Germany plays a decisive role in meeting global chemical demand, with 70% of the European export market coming from Germany. Globally, Germany is the third largest exporter of chemical products.

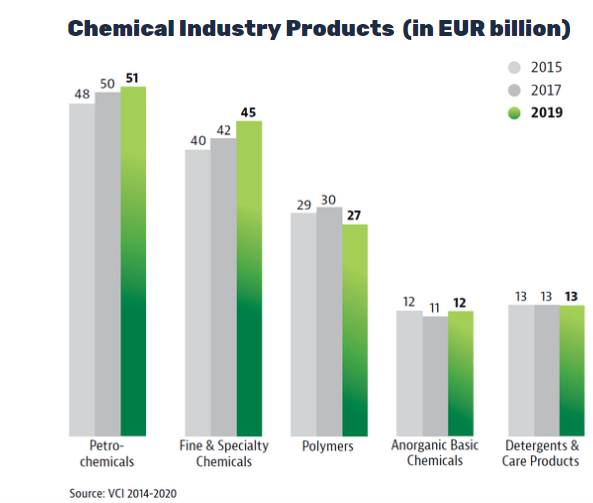

4. What products does the industry focus on?

“Fine and Specialty”, as well as “Basic Chemicals” continue to form the backbone of the German chemical production market. Many chemical companies have also started to develop downstream activities, which are found at the end of the chemical value chain (mainly products sold to industrial consumers).

5. Which are the main market segments?

Germany’s Chemical Parks: The Old Retainer

Through strategic investments and production optimization the traditional chemical production sites, (some of which are more than a century old) have been integrated into a network of highly integrated production sites. Germany’s unique Chemical Parks are connected by excellent logistics networks from road and rail to waterway and pipeline. With their plug and play concept they offer state-of-the-art conditions to infrastructure and on-site services.

From Commodities to Specialties

Generally speaking, there has been a development away from mass commodity or bulk chemistry to fine & specialty chemical production in Europe. With access to the necessary technologies and know-how required in the constantly growing specialty chemicals market, Europe and Germany are at the forefront growing faster in this space.

Pipeline

About one third of the 145 million tonnes of chemicals are transported by pipeline and an advanced net of pipelines for distributing crude oil, a major chemical carbon source. The pipelines of different chemical sites are connected to transport raw materials such as ethylene within the country and via Belgium and the Netherlands to neighboring chemical production centers and Europe’s northwestern ports. There are also hydrogen, carbon monoxide and oxygen pipelines between chemical parks with a specialized focus.

Refineries

Germany has 13 refineries with a total capacity of about 100 million tons per year, which is equivalent to 3% of global capacity, and eight steam-cracking plants. These supply the chemical industry with all of the necessary building blocks.

Rail

Germany’s rail system is composed of 43,470 kilometers of tracks with it’s high-speed railway network connecting nine neighboring countries, making it the eighth largest in the world.

Waterways

Finally over 250 inland ports serve Germany’s chemical complexes, with more than 2100 vessels transporting goods each year. With all these vessels the German inland fleet is able to transport 2.5 times as much as in 1998.

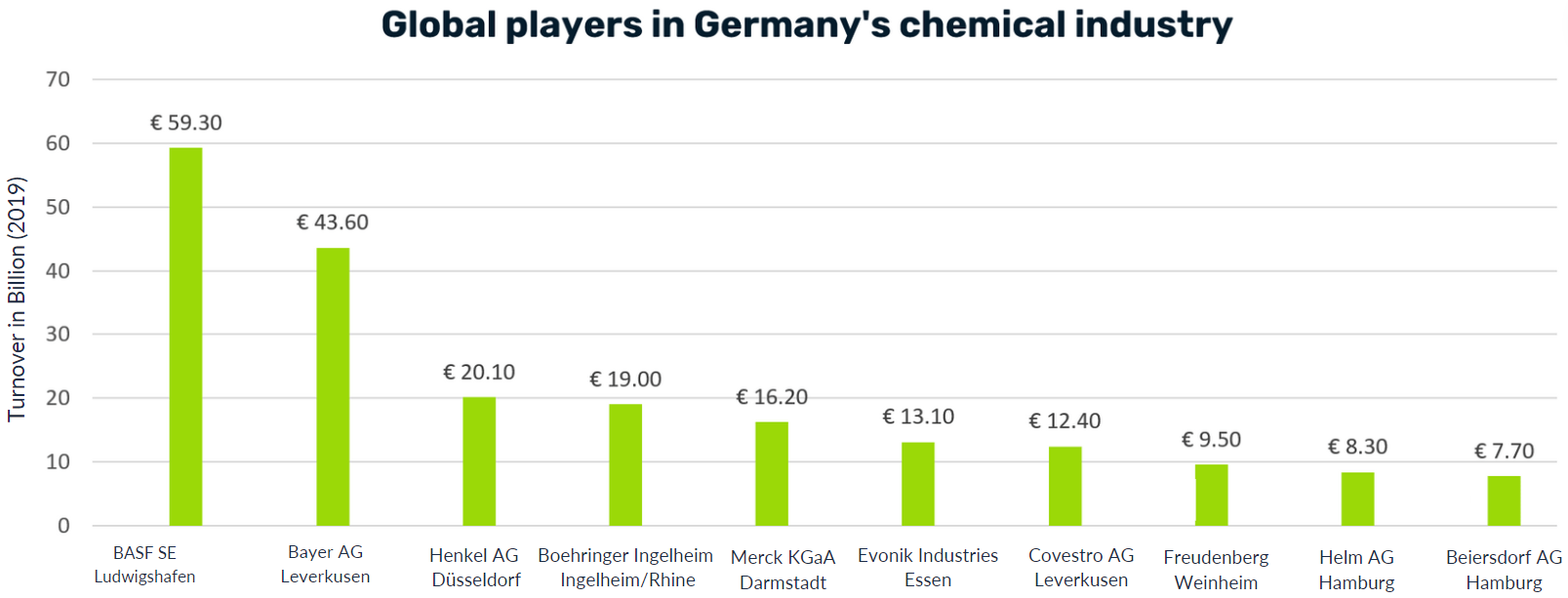

6. Who are the key players?

Germany’s chemical industry is characterized by a few global players and many small companies. Of the 2,200 companies, 93% have fewer than 500 employees, and 50% even less than 50 employees. The companies are not only pure chemical manufacturers but also have a diverse product range. The two largest chemical giants are BASF and Bayer, which are ranked 4th and 5th among the world’s largest chemical companies in 2019. Here’s an overview of the 10 biggest German chemical companies:

What makes Germany so successful?

Germany is known for its strict environmental standards, its obsession with sustainable energy, and high workforce costs. Yet Germany’s chemical plants are booming. Here are some of the reasons why:

1. Well-prepared Workforce

The highly trained workforce of more than 360,000 employees is one of the drivers for Germany’s chemical market performance. Germany’s unique “dual” training system offers a combination of vocational and advanced training with programs offered nationwide at more than 50 universities in areas such as chemistry, chemical engineering or biochemistry. This ensures there are enough skilled workers to meet the industry’s needs.

Another strength of Germany’s workforce is its high level of satisfaction. While on the one hand the workforce is one of the largest cost drivers in production processes, German employee motivation levels are very high. According to the IMD World Competitiveness Yearbook, Germans work more than their international peers (41.2 hours per week) and lose less days due to industrial action.

2. Central Location

Germany’s central geographical location at the heart of Europe gives access to 500 million European Union customers. The long-standing tradition of good relations with Central and Eastern European markets, especially Poland, the Czech Republic and Hungary provide a great deal of expertise. Further, Germany has an extensively developed road and rail network, connected to all neighboring countries, as well as a secure energy supply and communications infrastructure.

3. Enormous Research & Development

Germany benefits from tremendous research resources. In 2018, €105 billion were spent on R&D allowing a unique combination of industrial and institutional innovation that ensures Germany’s chemical industry can move faster than others across the globe. 70% of R&D spending came from companies and 23% from the federal government. The four publicly funded research units are the Max-Planck Society, the Frauenhofer Gesellschaft, the Helmholtz Association, and the Leibniz Association. Thanks to these research centers and their international collaborations with first-in-class academic partners, Germany can retain its status as an industry pioneer.

Along with strong research resources comes Germany’s chemical industry’s strong capacity for innovation as another success factor. With 2.8% of revenue spent on R&D in 2015 already, it makes Germany the continent’s innovation hub. It is therefore not surprising that Germany records the second-highest number of patents (18%) in the chemical industry at the European Patent Office.

5. Growth-Driving Industries

Another main contributor to the industry’s success in Germany is the presence of strong partnering industries, including the automotive sector with sales of more than €400 billion in 2016. By collaborating with industrial clients, and the global expansion of Germany’s industrial manufacturers, chemical suppliers have been able to expand into new markets.

6. Efficient Production

This strength in innovation combined with productivity and an efficient and networked production landscape makes Germany an attractive chemical industry production location. With a turnover of €157 billion (VCI) in 2018, Germany is a global heavyweight.

Despite all of Germany’s success, the country is under the pressure of global competition, especially from China, but also the United States. Furthermore, the worldwide COVID crisis weighed heavily on many companies leading to turnover falling by 6%. Although the chemical industry as a whole has been hit less hard than other sectors of the economy, Germany’s chemical industry plays an extremely significant role in meeting global chemical demand, thanks to its strengths in innovation, productivity, resource efficiency, strong client industries and cost-efficient production.